In today’s rapidly evolving financial landscape, digital assets have moved from niche curiosities to mainstream investments. Among these, digital gold stands out as a bridge between the time-honored stability of physical gold and the convenience of modern finance. This post dives deep into what digital gold is, how it works, and the compelling benefits it offers to investors, savers, and everyday users alike.

What Is Digital Gold?

Digital gold is a blockchain- or platform-based representation of physical gold holdings. Rather than buying and storing bars or coins in a vault, investors purchase tokenized units—each backed 1:1 by allocated gold stored in secure, insured vaults. These tokens can be traded, transferred, or redeemed for physical gold, all through an online interface or mobile app.

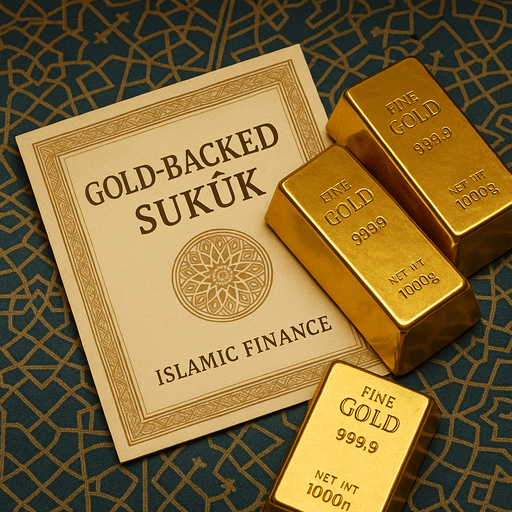

Key characteristics:

- 1:1 Backing: Every digital gold token corresponds precisely to a specific amount of real gold.

- Regulated Custody: Trusted vault operators (banks, bullion dealers, or third-party custodians) store and insure the physical gold.

- Blockchain/Database Ledger: Transactions and balances are tracked transparently—either on a public blockchain or via a secure centralized ledger.

- Instant Settlement: Buying, selling, and transferring digital gold happens in real time, without the delays of shipping or physical verification.

How Digital Gold Works

- Onboarding & Verification

Users sign up on a digital gold platform, complete KYC/AML checks, and link a payment method (bank account, credit card, or e-wallet). - Purchase & Token Issuance

When a user buys digital gold, funds are transferred to the custodian. The platform issues digital tokens representing the exact weight of gold acquired. - Secure Storage

The custodian holds the physical gold in high-security vaults, often audited regularly by independent firms to ensure backing integrity. - Trading & Transfers

Tokens can be traded peer-to-peer or on secondary markets within the platform. Transfers between users settle instantly, without involving physical movement. - Redemption

Token holders can request physical delivery of gold (e.g., coins, bars), or sell back their tokens for cash at current market prices.

The Benefits of Digital Gold

Digital gold combines the century-tested value proposition of gold with the speed, convenience, and accessibility of digital finance. Below are its primary advantages:

1. Accessibility and Fractional Ownership

- Low Minimums: Investors can start with as little as a fraction of a gram, making gold accessible to everyone—not just those who can afford full bars or coins.

- Global Reach: Anyone with internet access can buy digital gold, regardless of geography, regulatory constraints, or local dealer availability.

2. Liquidity and Instant Settlement

- Real-Time Trading: Unlike traditional gold markets that settle in days, digital gold platforms settle trades instantly, freeing up liquidity.

- 24/7 Markets: Many platforms operate around the clock, letting users buy or sell even when conventional exchanges are closed.

3. Transparency and Auditability

- Proof of Reserves: Blockchain-based platforms often provide cryptographic proof that the tokens issued are fully backed by gold.

- Regular Audits: Third-party auditors verify vault holdings, and many platforms publish audit reports to ensure trust.

4. Lower Costs and Reduced Friction

- No Physical Handling Fees: Buyers avoid shipping, insurance, and storage logistics commonly associated with physical gold.

- Competitive Spreads: Digital platforms can offer tighter buy-sell spreads thanks to automated order matching and lower overhead.

5. Security and Insurance

- Professional Custody: Gold is stored in fortified, insured vaults with strict security measures.

- Digital Safeguards: Platforms employ advanced encryption, multi-factor authentication, and cold-storage practices to protect users’ tokens.

6. Integration with Modern Finance

- Portfolio Diversification: Digital gold can be seamlessly integrated into robo-advisors, automated savings plans, or crypto ecosystems.

- DeFi Opportunities: Some tokenized gold products are compatible with decentralized finance (DeFi) protocols, enabling staking, lending, or liquidity-pool participation against gold-backed tokens.

Use Cases and Real-World Applications

- Retail Investors: Beginners can dip their toes into gold investment with small sums, building a hedge against equity volatility or inflation.

- Millennials and Gen Z: Tech-savvy generations prefer digital wallets and apps; digital gold appeals to them more than traditional bars.

- Global Remittances: Workers abroad can send digital gold to family members, who can then redeem locally or hold as savings.

- Corporate Treasury: Companies looking to diversify reserves can allocate a portion of cash holdings into digital gold for balance-sheet resilience.

- DeFi Enthusiasts: Users can wrap gold tokens into smart contracts, using them as collateral for loans or as part of yield-earning strategies.

Potential Risks and Considerations

While digital gold offers numerous advantages, investors should also be mindful of:

- Counterparty Risk: Dependence on the platform and custodian’s integrity. Always choose regulated and audited providers.

- Regulatory Landscape: Rules can vary by jurisdiction. Confirm local regulations regarding digital assets and precious metals.

- Platform Fees: Monitor transaction, custody, and redemption fees—these can eat into returns if not managed properly.

Conclusion

Digital gold represents a powerful synthesis of age-old value preservation and modern financial technology. By lowering barriers to entry, increasing liquidity, and embedding gold within digital ecosystems, it democratizes access to one of the world’s most trusted stores of value. Whether you’re a seasoned investor, a curious novice, or a treasury manager seeking stability, digital gold offers a compelling way to diversify and fortify your portfolio.

Ready to explore digital gold? Research reputable platforms, compare fees and security measures, and consider allocating a small portion of your assets to gain firsthand experience with this innovative asset class. Your future self will thank you for combining the best of both worlds—gold’s timeless stability and the agility of today’s digital finance.